No matter whether you’re a new start-up or a mature enterprise, there are significant benefits when it comes to using insights to guide your brand’s development and expansion. In this guide, we explore the key stages of growing a business and the brand and insight essentials you should be incorporating into your workplace and practices to ensure your brand is optimised for growth.

Start-up stage essentials: strong foundations

Mid-stage need-to-knows: changing business dynamics

Mature stage: market expansion

Want to read this guide offline? Download a PDF copy here.

This is an exciting stage for any start-up. You’re in the process of setting the business up, registering it, and getting it running, you might have even hired a few staff and/or an office space. On the brand side, you probably have your logo and a website sorted, along with the beginnings of a social media presence. If you’re already this far along and have a product in development, your marketing and sales hustle is likely in full swing, working hard to get those early investors on board.

However, just as this stage is exciting, it is also perilous. According to NZ Business Magazine, only 37 per cent of ‘micro’ businesses exist after two years. Other stats are only marginally better, with Stats NZ finding that of the businesses that began in 2016, only 41% survived into 2022.

When it comes to survival and growth, your start-up needs more than a great idea and product. You also need an understanding of your customer needs and market (including its other players) and a good grasp of your value proposition and how to communicate it. If some of these concepts are foreign to you or you don’t know where to start, don’t worry, we’ll go into more detail below.

It is important to mention that some businesses can be in a start-up stage even if their brand is at a more mature stage. For example, an established business creating a new product or establishing itself in a new region. If this is you, be aware that while your brand is mature, your off-shoot branch may face the same challenges as a new start-up.

While it is tempting for start-ups to skip this process and get their product idea developed and out to market, the customer discovery phase is one of the most important steps for a start-up. Without it, you risk wasting time and money on a product that doesn’t meet the market’s needs.

“Many entrepreneurs who claim to embrace the lean start-up canon actually adopt only part of it, neglecting to research customer needs.”

— Tom Eisenmann, Harvard Business Review, ‘Why Start-ups Fail’[1]

Customer discovery is the first and crucial step that must be done. This ensures you develop a product that actually meets customer needs, rather than what you think they need. Failing to conduct proper customer discovery could see your product false start, maybe even flop, which could have serious ramifications for your budding business.

The good news: this stage doesn’t have to be expensive or difficult. It simply means talking to people. This can involve a mix of internal experts from within your start-up and interviewing would-be customers. and people who operate in the field your product is designed for.

No. Internal experts and talking to your target audience are enough at this stage. However, we recommend using research to quantify your customer discovery findings once you’re out of the start-up phase and are looking to scale your business. We cover this in more detail in our mid-stage section.

We like to break up the customer discovery phase into three sub-phases: who your customer is, their needs, and their pain points. Below are some questions you might like to consider asking.

Who is in-market for your product?

What are their needs, both met and unmet?

What are their pain points?

Another major factor to consider in the process of establishing your product is market size. How many people will want your product? And who needs it now? (i.e. who is currently in-market for your solution?).

If your product is too niche, your resulting market size may not be large enough to allow your start-up to grow and scale. To avoid this, it is important to understand if there is enough appetite for your solution before you start investing resources into developing it.

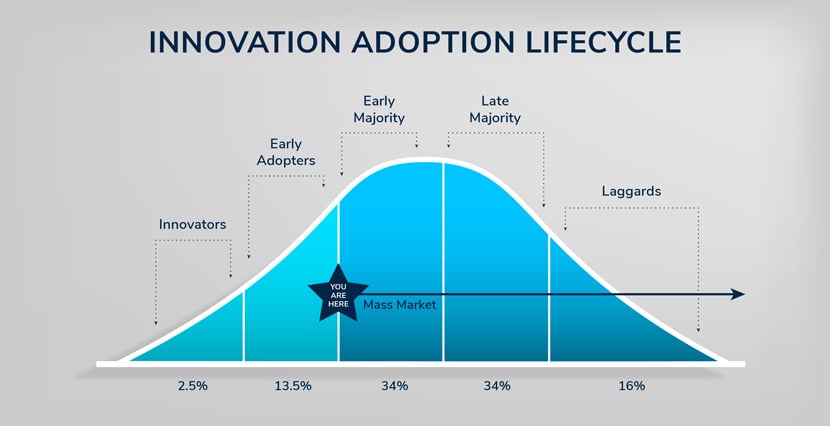

With your customer discovery phase and market sizing complete, you should be able to identify who the target audience is for your product. It is worth noting that regardless of your industry or product, a start-up’s target audience(s) will be early adopters who are actively looking to fix a particular problem or pain point. Most of your growth will come from these customers.

As part of your go-to-market strategy, it is important to understand the nuances of your target audience(s), such as how their sales cycles work, who the critical decision-makers are in their business, and whether they are operating in a B2B or B2C environment. It’s also worth considering how you’ll reach this audience. Will you target specific people, opportunities or channels in the market, or use a mass market ‘advertise to everyone’ approach?

SaaS early adopters tip: Generally speaking, early adopters of SaaS products tend to be tech savvy and thought leaders in their field. They are usually risk tolerant (that is, they are willing to take on risk, within reason, if they believe it will benefit them).

You can explore more of this topic with our free guide ‘Understanding Your Audience’ and learn how to research and segment your key audiences.

Communicating your value proposition relies on having a solid understanding of what other businesses are operating in the same space as you, what solutions are already in market, and how your product is different and/or better.

Understanding and communicating your value proposition is a lot easier when you have a clear understanding of the pain points your product is addressing and who your key audience is. If you’ve gone through the customer discovery phase, you’ll already have a solid understanding of both these points. However, at this stage, it is useful to focus your customer and market exploration using the 3 C’s framework.

Need help crafting your value proposition? Try this value proposition template from NZTE

Your brand (if any) is very much product focused, and your marketing is product led (i.e. tends to be short-term activations that promote your product). If your product is good, it often sells itself through word of mouth and in-market early adopters who are actively looking for the solution your product offers. At Perceptive, we call this stage, Phase 1: the target market phase.

Moving out of the early foundation phase into a mid-stage SME can be challenging for both a business and its brand(s), especially if you are new to the dynamics of running a larger business with many moving parts.

At this stage, your business is evolving (or has evolved) from one person managing all aspects of the enterprise to that person needing to delegate more and manage a team. As Craig Garner, Chief Executive of Business Mentors New Zealand, says, “It’s a move from independence to interdependence”.[2]

By this point, you should be using, and ideally actively collecting customer feedback to identify barriers and pain points in your product and rectifying them. Done right, this feedback loop will be growing the customer experience of your product and, as a result, building your brand, which is becoming increasingly important.

One of the major challenges at this stage in your SME journey is scaling up the business. From increasing your headcount to ramping up your marketing, there are a lot of hurdles to navigate. But no matter your product, industry or ambitions, all mid-stage start ups are going to encounter the same core conundrums:

The when and how of these answers may vary from start-up to start-up, however, here are a few key considerations and must-knows.

Listen: The Science of Scaling Podcast

If you’re new to the world of SMEs, it can be difficult to know when it is the right time to scale. While every business is different, there are a few signs that all businesses usually exhibit when they are on the cusp of expanding.

The biggest danger at this stage of your SME’s growth is scaling too early and overstretching your business. According to one study reported in Forbes, 70% of start-ups fail because of premature scaling. A key consideration, especially if you’re scaling into different regions or counties, is to have a solid understanding of what’s already operating in that new market and whether your potential customers have different needs as well as knowing if there are any different regulations you need to adhere to.

Greenlight signs:

Warning signs:

When it comes to scaling your business, it’s vitally important to stay in tune with your people. As your business scales, it will gain new customers, which increases the workload on your team. While a short-term high workload is manageable, is it not sustainable for long. Which is why hiring additional staff to help share the work needs to be part of your scaling plan. This may also require you to restructure your business as you/the business founder start to delegate whole aspects of the business to individuals and teams, e.g. handing over all marketing to an individual and/or team to run.

Greenlight signs:

Warning signs:

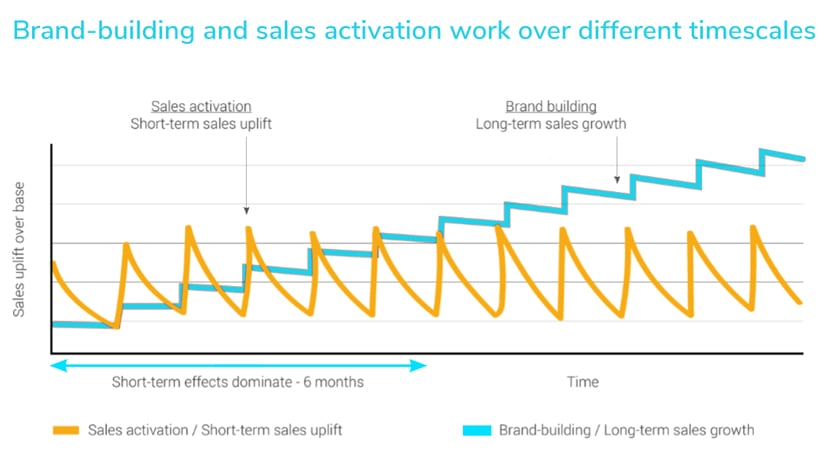

At this stage, your SME should have a strong word of mouth behind it. Client referrals are likely driving your customer acquisitions. Until now, you’ve probably experienced growth using short-term tactical marketing (i.e. using limited-time sales and promotions). However, as your SME moves beyond your core in-market audience, brand is going to start to become a major factor in customer acquisition. As such, your brand building activities need to step up to match.

When we say brand building, we’re talking about long-term brand activations that gain momentum over time. From brand advertising to experiences to community engagement via sponsorship or influencer marketing, these activities are not designed to sell a product like short-term sales advertising, instead they build memory associations with your brand.

Brand building requires talking to people long before they come to buy. It involves creating perceptions, memories, and awareness of the brand, and crucially, it involves making sure those memories last so when people come to buy, they already prefer your brand, and they keep preferring your brand, and keep coming back to it again and again and again.

—Les Binet, talking on ‘Marketing Effectiveness in the Digital Age’ at Screenforce Day Finland, 2019.

It is important to understand that brand building takes time. It is the tortoise to short-term tactical advertising’s hare. It may not deliver initially in the short-term, but over time its impact will grow and compound with your short-term advertising to increase your overall growth by more than if you had relied on short-term activation alone. For this reason, we recommend you begin brand building as early as you can—to allow time for your brand momentum to build.

Source: Les Binet and Peter Field, Media in Focus: Marketing Effectiveness in the Digital Era, IPA.

Greenlight signs:

Warning signs:

Learn more: How customer experience fuels your brand health

At some point in your mid-stage scaling, you’re going to find your SME is starting to sell to audiences that aren’t inherently attracted to your offering. This is a signal you’re moving out of the early adopter space and into the mass market.

[A graph of Everett Rogers Technology Adoption Lifecycle model. Source: Wikimedia Commons]

Unlike early adopters, the mass market may not be actively searching for the solution you’re offering. They may not even know they have a problem and that you have a solution for it. This is a where your brand building comes into play. The greater your brand awareness and mental availability, the more aware the mass market becomes of your offer and the more likely they are to seek out more information about your offering (i.e. brand consideration).

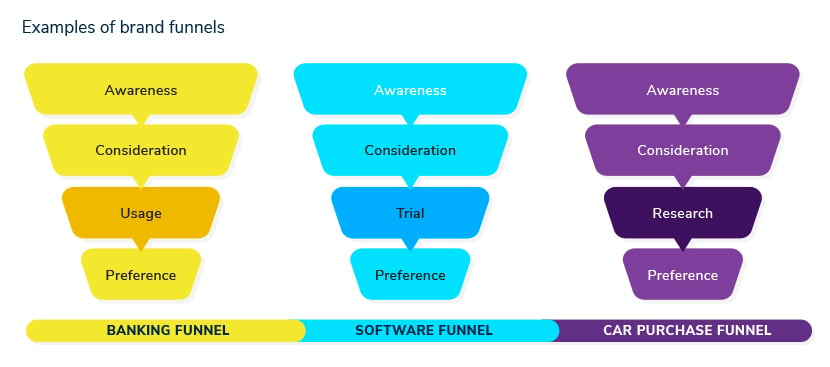

While a brand funnel and its metrics should be tailored to your business and key moments in your customer journey, they all tend to follow a similar structure, which we’ll talk to here. Every start-up will have a different combination of awareness, consideration, preference and usage KPIs and metrics that will reflect their business.

This may include metrics such as brand recognition, brand recall, share of voice, earned media coverage, social listening metrics (e.g. social impressions, engagement and click-through), and category entry points.

For an additional and powerful layer of brand awareness insight, consider tracking mental availability. This can include metrics such as network size, mental market share, mental penetration and share of mind.

This may include brand equity, brand sentiment, brand loyalty (using Net Promoter Score (NPS), calculating your repurchase ratio or tracking your customer lifetime value), brand associations, time on site, and consideration among your competitor set. Some of these brand consideration KPIs can be calculated from your sales data, monitored online via social listening, while others require surveys, such as NPS, and gauging consideration among your competitor set.

Similar to brand consideration, your brand preference KPIs can be revealed through surveys and brand loyalty metrics.

This funnel stage is frequently used by SaaS brands with trial offerings and can help provide insight into the customer journey and highlight strengths/weaknesses in your SME’s brand funnel.

While a market-wide survey will reveal the portion of consumers who have moved through your brand funnel to purchase your brand, you might also consider KPIs such as brand quality (calculated through post-purchase customer surveys), repurchase ratio, and brand loyalty, to assess how well your brand and product is satisfying your customers’ needs.

Important note! It’s not the number of metrics that matter. It is their relevancy to your business. The metrics you use must have a direct impact on your start-up, otherwise, you risk pouring time, money, and energy into improving metrics that don’t have any impact on your business. For this reason, we recommend hiring a market research professional or agency to help you design a bespoke brand funnel that accurately reflects your business.

Developed by Bain and Co, NPS[3] is a metric used to assess customer advocacy and their likelihood to buy from you again. Scores can range from -100 to +100. The higher the score, the higher your customer advocacy (and in turn, word of mouth) and likelihood of repeat customers.

NPS begins with a question: “On a scale of 0 (very unlikely) to 10 (highly likely) how likely are you to recommend [your start-up] to a friend or colleague?”. Customers are grouped according to the score they give your start-up with 0-5 scorers becoming Detractors, 6-8s becoming Passives, and 9-10s labelled as Promoters.

NPS is calculated with the following formula:

Promoter % – Detractor % = NPS

Read more: How do you calculate an NPS score?

Follow-up questions such as “Please tell us why you gave the score you did?” or “What could we do better next time?” can help uncover the strengths and weaknesses in your customers’ buying journey.

Employee NPS, or eNPS, operates on the same system, but instead of surveying your customers, you survey your employees to uncover the strengths and potential issues within your workplace.

Read more: What is a good NPS score?

As we’ve stated before, scaling your SME requires strategic planning. And the best plans are built on evidence and insights. Which is where market research and customer insights come in. Below are the key areas to help your business build a solid foundation of insights through its mid-stage and scaling growth.

As its name suggests, brand tracking assesses your brand funnel metrics as well as those of your key competitors to understand where your brand sits in the market. In addition to providing in-depth insight into your market position, brand tracking enables evidence-based decision-making on what aspects of your funnel to dial up and down to reach your goals. Perhaps most important of all, it is a critical tool for your marketing team to assess the effectiveness of their efforts. Without it, it is incredibly difficult for your marketers to understand the impact their brand and tactical activations are having.

At Perceptive, we recommend running a brand tracking study at least once a year to assess how (and if) your metrics are moving.

Learn more: How to track, measure and improve your brand health

Mapping out the interactions your customers go through in their buying journey is a powerful way to identify the “critical path” touchpoints or moments that determine whether a customer converts or walks away. Customer journey mapping also identifies your strongest and weakest touchpoints so you know what to capitalise on and what needs more work to make the buying journey as seamless as possible.

Segmenting your customers is an excellent exercise when you’re looking to scale your marketing and reach new audiences. From helping you identify your most profitable customer types to creating tailored marketing and messaging to attract different customers, customer segmentation allows your marketing team to be more effective and efficient.

Segmentation also allows you to create buyer personas, fictional personas that mirror the needs, attitudes, and behaviours of each segment. Personas are an excellent way of embedding your segmentation within your business and making them more memorable—and therefore, acted upon.

Developed by Tony Ulwick in the 90s, jobs to be done (JTBD) is a research framework that seeks to understand the tasks customers use a particular product for—and why. JTBD is particularly good at uncovering unmet customer needs, especially if customers are using your product outside its intended use. Think of it as the difference between using a chair to sit on (intended purpose) and standing on a chair so you can change a lightbulb (unintended use).

A JTBD segmentation is a qualitative exercise that involves interviewing and focus groups. While more intensive on the research side, its insights are exceptionally powerful for developing a customer-centric mindset within a business. Such insights not only help innovate your product it to be more user-friendly and meet new needs, but also open up new opportunities and markets as your product evolves.

Read more: The difference between market segmentation, customer segmentation, target audience and personas

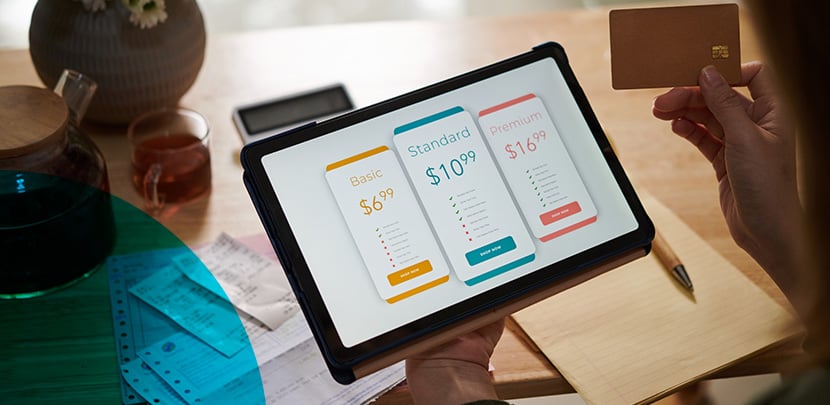

If you’re looking to roll out new features or products, it is often a good idea to test the market’s appetite beforehand, from pricing and price points to the most in-demand offers or features customers are willing to pay for.

While your start-up has probably already been collecting customer feedback since its early stages, mid-stage is where you must formalise the process. Regardless of which customer experience metric you choose to use (e.g. Customer Effort Score, Net Promoter Score or Customer Satisfaction), you need processes in place to regularly collect customer feedback, analyse it and report it to the business with action points to implement. How manual that process is and whether you hire talent to manage it or use a CX and/or EX platform, such as Customer Monitor, will differ from business to business.

The same goes for your EX metrics. Research has shown strong links between employee experience and customer experience, with positive employee experiences leading to positive customer experiences (and vice versa).

Read more: The 7 benefits of NPS: why use it over other customer satisfaction tools?

Again, you may have already informally explored your category entry points (i.e. when does someone go from not-in-market to in-market for your service/product). While internal discussion around your category entry points is good to have initially, at the mid-stage this is something that needs to be properly explored and quantified. Focus groups and interviews are an excellent way to explore the market—followed by a survey to verify both the findings and the degree of importance your various category entry points may have.

At this point, your business is a far cry from its start-up origins. At this stage, you’ve successfully scaled into a multi-team and likely multi-office/branch business and are now starting to push your brand into global territory and expand your products/service offerings. However, that also brings new challenges.

Deciding where to expand is often one of the first hurdles maturing businesses will encounter. Our advice: look before you leap. Whether you’re expanding into a new region or developing a product for a different market, you need to understand your product-market fit, brand presence, the similarities and differences to your current region/market as well as if there are other established competitors in the space you plan to move into. In the case of expanding into new markets, it is also worth considering any local nuances that may impact your ability to find customers and sell in this market, as well as any regulations you need to be aware of.

In short, launching new products and entering new markets requires a return to your start-up mentality. Do your research. Keep it agile. Collect and respond to customer feedback.

As a global brand, it stands to reason that different regions will have different goals and be at different stages of business maturity. Not to mention each region will likely have a different mix of customer types who have different needs and mentalities. With all these factors at play, building and unifying your brand over multiple offices, locations and countries is, unsurprisingly, a major challenge. Siloed thinking between your regions is an easy trap to fall into, which can hamper your ability to build and provide consistent brand experiences.

Unifying all regions under a global brand is a complex activity but not impossible. The secret to success is four-fold:

At this stage, you should already have a brand tracking programme in place to monitor your tailored brand metrics. To reiterate from previous sections, a good brand tracker has:

A funnel that reflects your customers’ buying journey

A software company that offers a trial, is going to have a trial stage between consideration and preference in their funnel (or between preference and usage depending on your customer journey).

Metrics that directly correlate to your business goals.

There is no point pouring time, money, and energy into improving a metric that has no relevance or impact on your business.

An established baseline.

Marketing and brand activations can impact the results of your brand funnel (as they should). However, to understand whether your marketing activities are having any impact, you need a baseline to work from. This usually involves running two or more brand studies—the first to set the baseline and the second to track improvements. Ideally, your ‘baseline’ brand tracking study should be done before any major marketing campaign or brand activation. Also take into account your peak sales periods in the year. In a B2C context, this could be periods around Black Friday and Cyber Monday, while for B2Bs if might be at the beginning or end of the financial year when businesses are considering their budgets.

With these basics covered, you can start incorporating more advanced brand health metrics, such as category entry points, to scale up your brand health tracking as a mature business.

These are the moments where a consumer moves from being out-of-market to in-market for your product or service. Measuring whether or not your brand springs to mind in these moments is an incredibly powerful way to understand where your brand is making connections and where it isn’t.

For example, imagine you’re a SaaS business with productivity tool for enterprise-sized businesses and you’ve commissioned some market research into your CEPs. The research has uncovered 12 possible category entry points where your brand and product should be considered by consumers. These CEPs might include managing projects, managing staff workload, calculating billable hours, reducing overtime, and cross-team collaboration.

However, the research also found your brand only comes to mind for two of those points, calculating billable hours and reducing overtime. With this weakness in your brand awareness identified, your SaaS company can now tailor its marketing and brand activities to build the association between your brand and the category entry points it is not yet known for.

Such information is hugely powerful for informing your marketing and business strategy. Building wider and fresher networks of associations for your brand means you come to mind more frequently in buying situations, which leads to more opportunities to convert a sale.

The brand that gets remembered is the brand that gets bought.

— Professor Jenni Romaniuk.[4]

Read more: Category Entry Points In A B2B World: Linking Buying Situation to Brand Sales

This goes hand in hand with brand health, especially as many brand tracking programmes include competitor analysis to help you understand how your brand is performing within its competitor set. However, as a mature business there are a few aspects of market position that you should be paying closer attention to.

Regardless of whether your brand is looking to expand or is already established in different regions, it is important to remain aware of your competitors’ activities in your market—both globally and locally. While brand tracking can help you understand the state of your competitors' sales funnels, a growing business should also look to identify any gaps or white space opportunities they could move into.

Part of understanding your competitor context also involves understanding consumer spending in your category. How often are consumers shopping in your category with you and with your competitors? How much, on average, do they spend—per transaction, monthly, yearly? Having this information not only allows you to assess the likes of your market share and who the major competitors in your market are but also helps you formulate your spending strategy going forwards.

“A good brand tracker looks both ways: into the past and into the future,” says Oliver Allen, General Manager at Perceptive. “By looking backwards, you can see what your category’s biggest fish are investing and spending on, whether those efforts were successful, and how your spending compares. These insights then guide how and what you spend on in the future.”

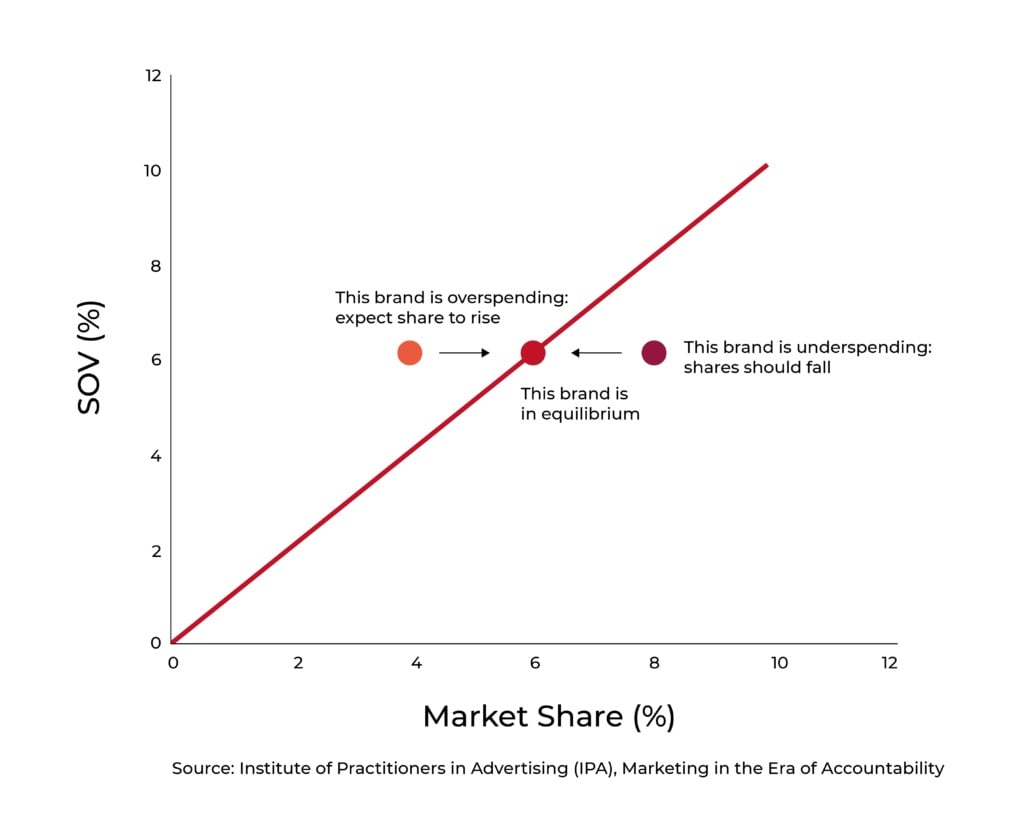

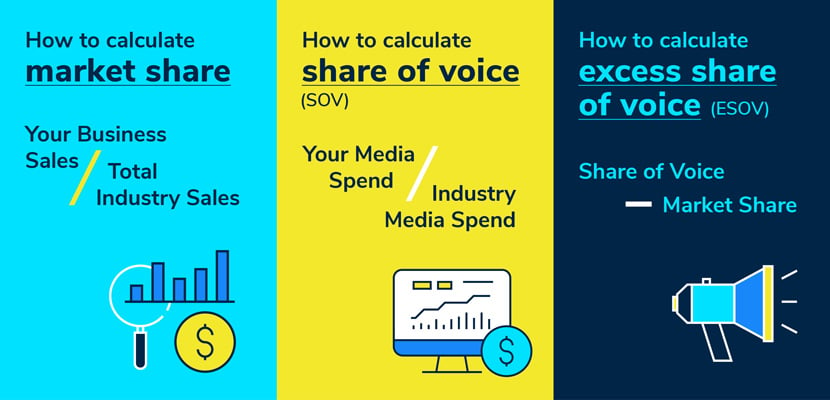

Tracking your market share not only provides an indicator of your business’ performance, but it also helps you forecast growth—particularly when paired with another powerful metric: share of voice (SOV). Research has found a correlation between SOV and market share where an organisation’s market share will mirror its SOV. For example, a company with a 5% SOV will, in turn, see a market share of 5%.

What’s interesting in this theory is when brands over or underspend on their SOV. When they overspend, their market share rises accordingly to match; when they underspend, their market share drops to mirror it. This overspending on SOV is known as Excess Share of Voice (ESoV).

Obviously, there will be differences between industry and brand maturity (with stronger brands being able to underinvest in SoV without losing as much market share), but the model holds true across a vast number of businesses.

Read more: Using your share of wallet to drive brand performance

Read more: Three marketing experts on how to achieve ‘effective share of voice’

While you’ve probably already conducted customer segmentation(s) during your earlier growth stages, it’s likely you’ve only done it at a regional level or with your current customers. As a mature business expanding into new territories, it is important to get a unified view of your customers on a global scale. A global customer segmentation will not only give you an in-depth understanding of category behaviour and entry points, but also identify the common pain points, needs, and jobs to be done (JTBD) for all your customers. This information is invaluable in creating a unified brand with consistent messaging, product positioning and unique selling points no matter which region or country it appears in.

On a regional level, a global segmentation provides a framework for regional teams to work with while still allowing flexibility to choose their target audiences, marketing execution, and to some degree, marketing messaging and creative. A strength of this approach is you are able to leverage the local knowledge of your regional teams, rather than having a global office dictate all their decision-making.

As a mature enterprise, you’re likely already collecting customer feedback and running a customer experience (CX) programme, probably with software and/or in-house staff or an agency to manage it. However, this is the stage where your CX programme needs to level up again to become a comprehensive programme capable of gathering customer feedback, analysing it, reporting it, and implementing business changes across multiple regions.

At this stage, it’s also critically important to have a team in place to respond and resolve poor customer experiences. Given that over 50 per cent of people will not buy from your brand again after one bad experience, and 73 per cent will switch to a competitor after multiple bad experiences[5]—if your CX programme does not have something in place to resolve customer complaints and win-back customers, your brand risks losing thousands of dollars in churned customers.

Your CX programme really needs to be listening and delivering on customer experience.

—Sammie Parkinson, Senior CX Consultant, Perceptive.

As a multi-regional business with employees across different offices, locations, and teams, it is now more important than ever to listen, respond and action employee feedback in your business.

In the past, you may have been able to engage with employees and collect feedback anecdotally and on an ad hoc basis. However, once you have multiple offices across different regions, this fast becomes unrealistic, even if you have a dedicated HR resource. However, it is still vital that your employees have a voice to feel heard. This is where, having a formalised employee experience (EX) programme comes into play.

An EX programme can take on many shapes depending on the size, structure and needs of your business, but a few recommended features include:

Whether your challenge is expansion or unification of your brand, it is important to make business and strategic decisions based on evidence. If you’re looking to expand your product range, consider NPD testing. If you want to build your brand in a new region, communications tracking and testing could be something worth looking into. Above all, remember that smart brands are built on smart decisions, and smart decisions are founded on evidence.

Want to read this guide offline? Download a PDF copy here.

[1] Eisenmann, T. 2021. ‘Why Start-ups Fail’, Harvard Business Review, May-June 2021. Available at: https://hbr.org/2021/05/why-start-ups-fail

[2] Baker, G. 2018. ‘The Fail Exposé’, NZBusiness. First Published in NZBusiness September 2018. Available at: https://nzbusiness.co.nz/article/fail-exposé

[3] Net Promoter®, NPS®, NPS Prism®, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld. Net Promoter ScoreSM and Net Promoter SystemSM are service marks of Bain & Company, Inc., NICE Systems, Inc., and Fred Reichheld.

[4] Romaniuk, J. 2022. ‘Category Entry Points In A B2B World: Linking Buying Situation to Brand Sales’, LinkedIn Corporation and Ehrenberg-Bass Institute, University of South Australia.

[5] Zendesk, 2023. CX Trends 2023: The Rise of Immersive Experiences. www.zendesk.com