The Age of the Customer is here

What is the Net Promoter Score (NPS)?

Mastering voice-of-customer surveys that use NPS

How to leverage the Net Promoter Score

Practical advice on implementing NPS

Common Net Promoter Score mistakes

Short on time? Download a free copy of this guide to read offline!

Customer experience (CX) has overtaken price and product as a key brand differentiator.

With electronic and traditional word of mouth reigning king, delivering a superior experience to your customers is not just best practice, it’s baseline practice. Customers expect excellence. And failing to deliver can make or break a brand.

Sounds simple enough, but here’s the sticking point.

There’s a gross mismatch between the number of businesses who claim to deliver an excellent experience and the number of customers who say they receive said excellent experience.

Eighty per cent of businesses say they deliver a ‘superior’ customer experience. However, only eight per cent of people think that these same businesses actually do.1

The purpose of measuring customer experience is to uncover opportunities for improvement within your organisation. If you choose not to act, you only have 50 per cent of the solution.

—Damian Bennett, Business Director at Perceptive Group.

A superior customer experience breeds loyalty. And loyalty is good for business.

Customer experience (CX) leaders can outperform CX laggards by nearly 80 per cent.2 Moreover, the customers of CX leaders are seven times more likely to buy more from the company, eight times more likely to try other products or services, and 15 times more likely to spread positive word of mouth, than the customers of CX laggards.

In short, loyalty pays. But to grow loyalty, you need to understand your customers.

The CX flywheel harnesses positive customer experiences to drive sustainable growth. Learn how the flywheel is transforming businesses with our free white paper.

With customers at the heart of 21st Century business, customer insight tools are shining a light on what companies think they know about their customers and what they actually do.

Understanding why customers do (or don’t) come back is a major part of this—which is where NPS comes in. NPS, short for Net Promoter Score, is a proven, powerful metric used globally to measure customer advocacy and loyalty levels.

NPS is not a metric for management eyes only; it is relevant to every employee in your business. Everyone can get behind it. Best of all, it’s simple. But don’t think that simplicity equals shallow insight. Used in the right way, NPS can uncover strengths and weaknesses relating to your brand and overall business, from operational strategies right down to critical customer touchpoints.

The purpose of measuring CX is to uncover opportunities for improvement within your business. In short, it should highlight positive changes. If you choose not to act, you only have 50 per cent of the solution.

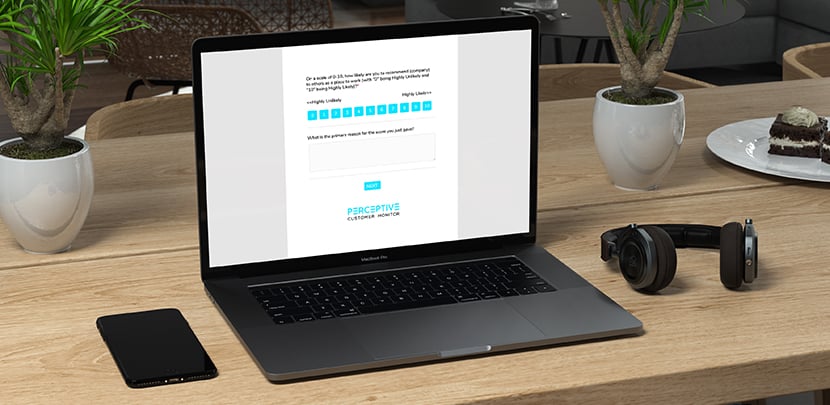

NPS begins with a question:

“How likely are you to recommend our company/product/service to a friend/family/colleague/others?”

Answers range from 0 (Not at all likely) to 10 (Extremely likely).

We generally recommend a follow-up question is asked—we call it the ‘NPS Driver Question’—inviting customers to explain why they gave the score they did. This allows themes that are either driving advocacy up or down to be uncovered.

NPS segments 'customers' into three distinct groups: promoters, detractors and passives, depending on how they answer the NPS question.

Detractors (at risk):

Passives (noncommittal):

Promoters (advocate):

To calculate your NPS score, subtract the percentage of detractors from the percentage of promoters.

Promoter % – Detractor % = NPS

For example, if you had 100 responses with 60 Promoters (Promoters = 60 per cent) and 20 Detractors (Detractors = 20 per cent) this formula would become:

60 – 20 = A Net Promoter Score of +40

This means a business' NPS can range from -100 to +100. The higher the score, the higher your customers' loyalty.

NPS has a variety of applications, but it is typically used as part of brand health tracking programmes and voice-of-customer programmes. In both instances, it is typically included as part of a quantitative online survey.

Brand health tracking programmes are generally focused on measuring how well a brand performs across certain conversion metrics for example: Awareness, Consideration, Usage and Preference. This is usually done in tandem with key competitor brands so you can determine your overall market performance. These metrics can then be tracked over time to quantify the impact of any new campaigns that are launched. NPS is used to measure preference/loyalty over the course of your brand health tracking.

Read more: Tracking Your Brand Health [Free Guide]

VOC programmes involve capturing regular customer feedback with the aim of fuelling continuous improvement at a brand or department level through to specific customer touchpoints.

Feedback is typically captured by a short (2- to 3-minute) online survey and the responses captured and analysed via a dedicated CX management system. At a basic level, this system should alert a business to any low-scoring customers, so issues can be quickly and effectively resolved before they turn into major problems and prevent customer churn.

While the Net Promoter Score provides a metric to track and benchmark, the real value comes from analysing the answers to the follow-up questions to uncover the underlying drivers behind the score (NPS drivers question).

These responses are a valuable source of insights, which can be used to identify themes driving advocacy either up or down and to what degree. This helps inform the development of action plans that focus on improving your overall customer experience. This can range from introducing new e-commerce features to improve product browsing; to operational overhauls of processes and procedures that fuel customer support call centres, for example.

NPS is just one metric you can use to measure and track customer experience. As a business, you should choose a metric—or a combination of metrics—based on what your objectives are.

NPS goes beyond ‘satisfaction’ to measure advocacy, which is linked to loyalty and trust. High levels of advocacy, particularly with the rising prevalence of e-word-of-mouth, are associated with growing brands.

When garnering customer feedback, NPS is typically used in conjunction with two other metrics:

to provide an additional lens on customer experience.

CSAT and CES are both typically short-term indicators used to measure a particular interaction or transaction, e.g. a customer’s last purchase experience with your business.

|

NPS |

CSAT |

CES |

|

Is a measure of customer advocacy, which is linked to customer loyalty and trust . Long-term indicator. Can be used as a brand health metric, to aid customer churn forecasting, and assess how key customer journey stages are performing. Set methodology, i.e. the question must be asked in a specific way and use the scale of 0 to 10. It is calculated by subtracting the percentage of detractors from the percentage of promoters. Set methodology means it can be used to benchmark against competitors and internally. Easy for all levels of staff to understand. |

Gauges satisfaction towards a specific product or service-interaction. Short-term indicator. Used to measure a particular interaction or transaction. Therefore, it is important to survey customers as soon as possible after their interaction/transaction. No set methodology. No specifics on how the question should be asked. No set scale required (e.g. 5-point vs 7-point), therefore, the calculation can vary. Useful internal benchmark. Easy for all levels of staff to understand. |

Measures how much effort customers had to put in to have their needs met. Short-term indicator. Used to measure a particular interaction or transaction. Therefore, it is important to survey customers as soon as possible after their interaction/transaction. No set methodology. No specifics on how the question should be asked. No set scale required (e.g. 5-point vs 7-point), therefore, the calculation can vary Useful internal benchmark The concept of effort exerted by a customer takes a little bit longer for staff to understand. |

NPS makes for an excellent business KPI to track because of its connection to growth and brand health. Maintain your NPS and you’re likely to see positive results across the board.

Better yet, NPS is a KPI that is relevant to all employees because their everyday actions can measurably affect it. Imagine if Amy from accounts discovered that one of her favourite contacts left her a glowing review through a recent survey, scoring her a full 10/10 and boosting her personal NPS as well as her department’s.

You use NPS to set KPIs for your frontline staff, as well as your business as a whole. You can analyse your survey results for any themes or patterns that can help individuals to drive performance and improve customer experience.

Read more: How to leverage NPS

NPS is a globally-recognised metric with a set methodology. This makes it easier to benchmark against other companies and competitors in your industry, and track your progress over time.

Suggested reading: New Zealand NPS Industry Benchmarks or Australia NPS Industry Benchmarks

NPS helps businesses see the “bigger picture” and gauge their customer loyalty week to week, month to month, and year to year. It is easy to see windfalls and losses.

Moreover, the score can also be used to compare how different teams, territories, customer segments etc. are performing. This provides valuable behind-the-curtain insights into the strengths and weaknesses within your business.

Understanding NPS is simple as it’s expressed as a score between -100 and +100. This makes it easily digestible to busy executives and general staff alike. What’s more, it breaks down the results into three customer groups: promoters, detractors and passives.

The result? Everyone in your company speaks the same language when it comes to customer success.

You can conduct an NPS survey by phone, email or via a website. With the right CX management system, you can also compile and share results quickly, making it easy for people to review your findings and evaluate performance. It also offers flexible use in various business settings.

For example, Apple is an NPS leader in the tech space. And part of the reason behind their success is how they’ve incorporated NPS into their 300 plus retail stores.4

After a purchase, customers will receive an NPS survey email. Any detractors are called within 24 hours, and the comments from Apple’s promoters are circulated through the staff.

Moreover, to ensure their staff are engaged, and therefore brand promoters themselves, Apple also conducts employee NPS (eNPS) surveys with their employees and take on board employee feedback.

NPS can help you uncover the strengths and weaknesses in your customer journey. For example, an insurance company may track NPS at the onboarding stage of new customers, when a claim is submitted, and when a policy is renewed.

Consumers are becoming increasingly more distrustful or marketing and sale messages. The internet has helped customers to become more educated and savvy when making purchasing decisions, which has led to a resurgence in word of mouth. People no longer turn to sales and marketing for buying advice, they turn to friends, family and colleagues.

To grow positive word of mouth, you first need to understand what people think about you—the good and the bad. NPS can help you unearth this critical feedback, capitalise on what you’re doing well and minimise what you aren’t. When customers are advocates, good word of mouth will follow.

NPS will also detect your most unhappy customers who are likely sharing their experiences and damaging your brand's reputation. These people are perhaps your most valuable when you’re looking to improve overall customer experience. Without their feedback, you can only guess at what you need to work on. What’s more, resolve their issue quickly, and you might even “save” them from churning. Lastly, NPS can also help you prioritise which customers to respond to first.

Read more: 5 tips to help you approach your most unhappy customers

The great thing about NPS is that it is simple, but at the same time this has often been seen as its downside. It’s been argued that using one or two questions doesn’t provide as much data compared to a full customer survey.

Finally, NPS is worth nothing unless you have a strategy in place to actually act on the results and respond to the feedback you’re getting.

Despite this, NPS is still considered to be one of the most relevant scores in assessing customer loyalty and building customer relationships.

Ultimately, the score your business gets is just the beginning. NPS is a full system that creates the conditions to implement genuine change and improvement.

There is more than one way to deploy an online voice-of-customer survey that incorporates NPS—via an in-store kiosk, text message and/or email are the three most common. At Perceptive, we can accommodate all three and have the ability to integrate responses with interactive dashboard technology that automatically captures and analyses customer feedback.

Cost effective and quick: There are less setup and administration costs, no interviewer or focus groups to organise (or pay), and if you use an online customer survey management system, you can quickly create, administer, collect and analyse responses.

Automation and easy access: Most online survey platforms collect responses and store them online for easy viewing, making them accessible at any time. Analysing and sharing the results also becomes easier and more streamlined.

Convenient: Surveys deployed online generally allow certain information we already know about a customer—such as existing CRM information—to be automatically appended to a response. This means questions to identify a customer's age, the industry they work in, and the product/service they use, for example, don't have to be included.

Moreover, in the event of, say, a distraction or a loss of internet connection, a well put together online survey will allow respondents to pick-up where they left off.

Smart: A good survey platform will allow you to introduce advanced question logic into a survey. For example, depending on the answer a customer submits for certain questions will determine which subset of follow-up questions are asked later in the survey (or not asked!). Navigating such logic when conducting a survey via phone can be tricky, but an online survey offers a more seamless experience.

Relies on accurate contact information: Like any customer feedback initiative, online surveys rely on accurate contact information, namely email address or mobile number. To be effective this relies on effective database maintenance, as well as regularly reviewing the process and procedures surrounding this.

Relies on internet connection and email address: While most people have access to the internet, email and a smartphone, there are some segments of the population where online surveys fail to cut-through, such as subsets of the elderly population and the NZ farming sector.

Getting noticed: Due to the volume of emails, there’s a chance that your customers overlook your survey invitation in their inbox. Counteract this with a well-targeted invitation, with a clear message and ensure you consult the wider marketing and communications calendar before scheduling to avoid overlaps.

Keep your business objectives in mind: What are the objectives of the survey? This could be setting KPIs, employee retention, or measuring the performance of key touchpoints.

Keep it short: Between 2-3 minutes. This will increase your response rate.

Keep it simple: Use a few, easy-to-answer questions to make the analysis of your survey responses easier. Unless you have a customer experience management platform that can accomodate more sophisticated types of analysis.

Find an independent research partner: If a third-party provider runs your survey, you get an independent view of your customers’ feedback. A third-party provider can also provide peace of mind to customers in situations where anonymity is critical to receiving candid feedback, for example, in an employee/workplace survey. Moreover, if your survey captures sensitive and/or personal information, a reputable third-party provider will have the necessary security in place to protect that information.

Use jargon: Use common words and keep your language simple to reduce the chance of questions being misunderstood. This will also help to increase your response rate.

Colour coded scales: Colour coding scales or introducing emoticons, particularly when it comes to the NPS scale is a major no-no. Doing this signals to respondents which numbers are considered good, cautionary, and bad—thus turning what is meant to be an 11-point scale into a 3-point scale. This goes against the NPS methodology.

Include restricted multiple choice questions: It can be frustrating for the respondent if multiple choice answers don’t include the response they want. They may not complete the survey as a result. Give them an 'other' option with an open text response box for them to give a short explanation.

Send a survey months after a customer’s purchase: A badly timed survey is not ideal—unless it's a relationship-focused survey aimed at gauging the overall health of your relationship with your customers. Aim to deploy a survey soon after a purchase or interaction.

What is considered a “good” NPS survey response rate will vary greatly from business to business, depending on your target audience.

Generally, when it comes to short surveys used in voice-of-customer programmes, the average response rate sits between 18 to 20 per cent. This is, however, dependent on the existing customer engagement levels, sentiment, and industry.

Some tactics to improve response rates include:

The short answer: any NPS above 0 is "good", as it means that your audience is more loyal than not. Anything above +20 is considered "favourable". Above +50 is excellent, and above +80 is world-class.

We see a range of scores at Perceptive. Across New Zealand and Australia we consider anything above +20 to be ideal, while scores between +30 to +40 are considered healthy. However, these goals will change depending on your industry's individual benchmarks and location.

Well-known, high-growth companies from the US, such as Amazon, Harley-Davidson, Zappos, Costco and Dell, generally attain NPS efficiency ratings of +50 to +80.

Remember the score is just the beginning. Focus on identifying the underlying themes behind the score and putting plans in place to address them.

Suggested reading: The top 3 Net Promoter Score industries in Australia and New Zealand.

You may be tempted to do this when your score is high—but what happens if your score drops? This is just one pair of positives and negatives that must be balanced. To help you, we’re going through the reasons that you may decide to publish your NPS for each of your main audiences.

The three main groups to take into account are: your employees, internal stakeholders (such as your board and investors), and your customers (and everyone else).

Yes, you should include your employees.

You can use NPS to motivate your employees to deliver a better customer experience when keeping your team up to date on performance trends. They will see how their efforts impact the experience and perception of customers and adapt accordingly.

To ensure you’re reaping the full rewards of your NPS program, you should include trending information such as how you’re tracking against your other key performance indicators, and how you plan to act in response to customer feedback.

How much you reveal will depend on what decisions are affected by this transparency. You may only want to reveal the full detail to those who are in a leadership position, or you may want to discuss this with your entire staff to ensure the entire company is on board.

In essence, every employee should know how his or her role improves the change in overall customer sentiment.

Sharing your data with your board, investors and other stakeholders is usually a given. As they have a vested interest in your company, they need to know how your company is performing.

Even if you’re performing less than adequately, having a solid plan for how to improve your score will put you in good stead.

If you’re a public company, you’ll have to disclose the information to all investors.

Choosing to publish your score on your website or in your email newsletter can be a good idea. It can:

Give you the competitive edge by reinforcing your business’ commitment to customer experience and credibility. This needs to be backed up by your employees’ continuous actions of course, but it can really make you stand apart from your direct competitors.

Resonate with your customers. Sharing a credible and engaging brand vision at the same time you’re disclosing your score, will resonate with both your future and current customers and act to boost your authority.

Help your recruitment drive. A good score may also mean that people who are looking to work at your company take notice. Prioritising excellent customer service often means people will want to work for your brand, as the relationship between loyal customers and employees is interlinked. If you promote your customer-led culture widely, this will help with sourcing new recruits too.

NPS is more than a measure of business health. It is a means to understanding your customers—past, current and future—and what drives them to (or away) from your business.

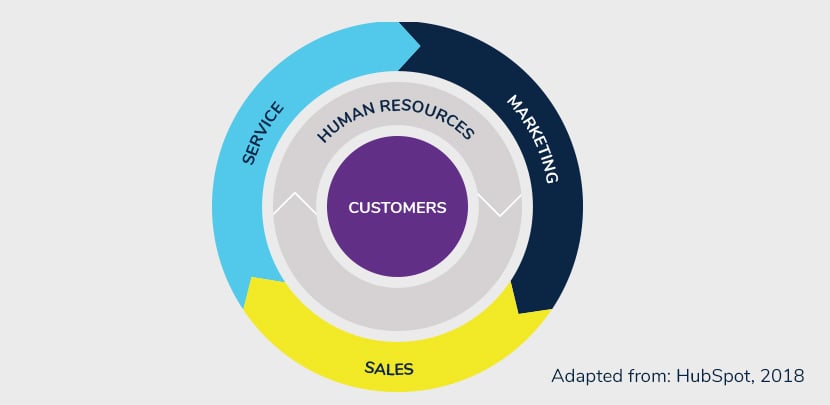

These are some of the ways NPS insights can be leveraged by key business divisions:

Direct growth strategy: NPS measures brand loyalty and a business’s chance of gaining repeat and new business. This information can aid in your company’s cash flow predictions and strategic planning going forward.

Improve brand health and strategy: While the NPS number might indicate customer loyalty and the health of your brand, it can also provide insights into how well your business strategy is performing, as well as whether your product or service is aligned with customer expectations. Our clients, 99 Bikes, for example, use key insights from NPS data to drive their business strategy across Australia.

Uncover opportunities: Survey feedback can offer a wealth of insights into weaknesses plaguing your customer journey. Improve on these and you could see gains in various facets of your business.

Measure the impact of new initiatives: With the right NPS management system, you can identify trends and measure performance over time, allowing you to see the impact of any changes made within the business.

Assess performance: Depending on how you set up your NPS programme, you can compare performance across teams, offices, products and services—and allocate resource where it’s most needed. This is especially valuable for businesses with multiple branches and/or with individual consultants (such as a real estate agency). If a branch or consultant has a lower NPS than the rest, it may indicate that not everything is 'working' optimally. This could be due to workload, insufficient training or inadequate systems or processes, and NPS feedback may help uncover this.

Create a customer-centric culture: NPS relies on customer insights to create a strategy of ongoing improvement and customer centricity. With the right platform, you can use NPS to capture feedback and uncover trends within that feedback to guide business decisions. Better yet, you can track what impact your changes have on your customers—from policy changes to new systems and processes.

Map out your customer journey(s): NPS feedback can reveal how customers interact with your business and the strengths and weaknesses of specific touchpoints. This can help you map out their path-to-purchase and focus your marketing efforts on the most influential touchpoints, or identify gaps along the journey.

Segmentation and targeting: Customers identified as promoters can be used as a seed audience to generate powerful lookalike audiences to drive new customer acquisition. In a similar way, you can remarket to detractors and passives to communicate plans to rectify common shortcomings and improve customer experience. They also represent a valuable recruitment source for qualitative research (e.g. focus groups) that can be used to test improvement plans and concepts prior to implementing them.

Engaging brand stories: Powerful word of mouth testimonials from your Promoters are a great source of case studies and can strengthen both brand consideration and preference over competitors.

More informed: Sales tams have a better understanding of what is most important to customers and can adjust their approach when targeting new prospects and better anticipate and answer a prospect’s questions.

Prioritise leads: Sales teams can learn which prospects are most likely to become customers as well as discover at what stage customers are ready to purchase, through journey mapping. This can help them prioritise leads, become more efficient and achieve higher conversion rates.

Identify at-risk customers: This allows account managers to put a save plan in place to prevent customers from churning.

Identify weak touchpoints: Be it online ordering, customer return processes or call centre response time, NPS feedback can help identify areas of friction and repair them before they cost you more customers.

Identify common support themes: This can help you implement self-service channels, such as a knowledge base or chatbot strategy, designed to quickly solve common customer issues. In turn, this frees up your customer support staff to tackle more complex service issues.

Save customers: With the right NPS management system, you can collect results daily and if you act fast, you may be able to repair the relationship with a customer and stop them churning. This won’t always be the case, but in addressing the issue quickly, you may save other customers from going through a similar experience.

Pinpoint painful touchpoints: With NPS, you can pinpoint painful customer touchpoints and understand the processes and interactions that shape them. For example, a survey may reveal that your returns process takes too long and is overly convoluted. This might prompt you to simplify the process and look into ways to resolve the issue quicker. With this painful touchpoint resolved, your customer journey will flow into a more seamless experience.

Better products and/or services: With NPS, a feedback loop is established, which gives you vital feedback on your products and services. NPS also uncover opportunities to expand or grow your products and services. Customers might say “I wish it did this” or “I thought it would do that, but it doesn’t”. While not positive, this feedback provides valuable insight into your customer needs and way in which you could meet them.

Recently, Burger King used an NPS programme to help them gain new insight into their customers, which has helped them develop a new range of products and refine their marketing strategy—with great success.

Case study: Customer insights deliver Whopper results for Burger King

From a human resources perspective, NPS offers two opportunities:

Staff training and resourcing: Customer feedback can provide insight into where your business can improve, including where you can implement training to better equip staff to improve the experience they provide to your customers.

Employee engagement: Only 19 per cent of employees are inspired and satisfied in their line of work. Why is this important? You may work hard to keep your customers happy by collecting feedback across multiple touchpoints, and making improvements. But managing customer satisfaction externally is only part of the equation. What about the employees who serve your customers? Conducting an employee NPS (eNPS) survey can help you measure staff advocacy and their willingness to be an ambassador of your brand, and ultimately, improve customer experience.

Tip: Share the feedback from your top promoters with your wider team, especially if they had a role in creating a great experience for a customer. Not only does it reinforce that they are doing the right thing, but it’s a great morale booster too.

When used correctly, NPS can help you implement smart, effective changes that impact on multiple levels of your business.

Collecting and acting on customer feedback has a unique way of re-aligning your business to the needs of your customer, and in doing so, transforming your approach to each business function, department and discipline.

—Damian Bennett

Building a culture around NPS not only challenges both individuals and teams to deliver the best customer experience possible, it helps them understand how they contribute to those experiences. This is why NPS results should be shared across the organisation and employees continually encouraged to identify ways they can contribute to improving customer touchpoints.

Define key customer journeys and customer success metrics for the different touchpoints along each journey.

Survey the different customer journey stages across the business to pinpoint any sources of friction.

Measure CX from the top of the customer journey through to its finish.

Use employee feedback (for example via an Employee Net Promoter Score system) to identify any areas for improvement.

Establish solid leadership and governance structure to aid the shift to a customer-centric business.

Define and prioritise the outcomes that really matter, focus on the pain points and customer experience issues that have the highest financial value. Analyse your satisfied and dissatisfied customers over time.

Assign a Chief Customer Officer to champion the customer advocacy and loyalty across different teams within the business.

Acknowledge early wins and share them with relevant stakeholders to demonstrate that your programme delivers value.

As many as 96 per cent of unhappy customers don’t actually complain directly to the offending company, and 91 per cent of those will simply leave and never come back. When you’re not succeeding, most of the time you won’t even know.

Don’t panic if you’re getting bad feedback—it’s normal, even for successful companies. The important part is what you do about it, and how quickly you action it.

What does a loyal customer look like? A loyal customer values your product and services; would recommend your brand to their friends and family; and are loyal to your company. This means that their lifetime value will be high and cost you less to serve.

Unhappy customers, on the other hand, cost you more to serve, values your services less and is likely to easily go to one of your competitors.

How do you know you’re doing badly? A business loses its customers when either the following three (or all), of these scenarios occur. The customer:

1. Experiences a problem

2. Finds it hard to make contact with the company to ask for help, and

3. Is dissatisfied with the response they get.

You should welcome both bad and good feedback. It gives you the opportunity to learn from it. Listening to and learning from your unhappy customers (ideally through regular customer feedback surveys) creates a constructive feedback loop.

You need to thank your detractors for taking the time to provide feedback and express gratitude for them being honest. Ask them for the one thing you could do to change their experience with you. If they’re really unhappy, contact them personally and see what you can do to retain them as customers.

No matter whether you’ve just started using the Net Promoter Score (NPS) or you’re an old hat at it, approaching your most unhappy customers—your detractors—is not always easy. However, the longer an unhappy customer is left alone, the more money is costs your company. You'll have fewer repeat purchases, less customer lifetime value and subsequently, you will have to acquire new customers to replace the old ones who leave. This is why it is crucial for businesses to know which customers are the most at-risk of leaving.

When you hear that someone isn’t happy with your product or service, it is also the perfect opportunity to find out why. This creates a constructive feedback loop of that your detractors are often happy to be a part of.

Here are six tips to approach detractors:

We recommend getting in touch within three working days. Waiting a week not only means your NPS survey is no longer fresh in your detractor’s mind, but it shows a lack of interest on your part, which can further damage your brand in the eyes of that customer.

As a broad-sweeping rule, calling is better than email. Where a phone call can convey tone and mood, emails do not—and it can lead to unintended grievances. However, if you’re an international business with overseas customers in different time zones, it may not always be viable to call.

In a recent study Perceptive conducted with GIO (Suncorp Group) that targeted injured workers, we found that 73 per cent of respondents would prefer a phone call rather than an email.

When you get in touch with an unhappy customer, keep the conversation natural, rather than scripted. Following a cookie-cutter script for every phone call is a sure-fire way to irritate your detractor even further.

When it comes to listening to your detractors, understand first, console second. Understand the root cause of the customer’s problem. Why did it happen? When did it occur? Then consider what and who could help resolve the situation. Simply hearing them out can usually ease the pain. Most customers are looking for acknowledgement, and showing genuine compassion and empathy goes a long way.

Share the feedback with the employees it directly affects as soon as possible. Also include anyone who creates a process that impacts a customer’s experience within the company. Remember to keep them in the loop every step of the way, until the resolution phase, so that a clear outcome is planned for and communicated.

Keep tabs on what stage your detractors are at. Are they awaiting contact? Have they been contacted but have not responded? Are they resolved? This is particularly important if more than one person is contacting your detractors. Set a goal or KPIs and reinforce the right sets of behaviours shown above.

Suggested reading: The three Cs of dealing with customer complaints using

the Net Promoter Score

If you conduct regular Net Promoter Score (NPS) surveys to get customer feedback, gauge sentiment, brand health and likelihood for repeat business, chances are you’ll know who your most valuable customers are.

These are the customers who give you a perfect score—10 out of 10. They are your most valuable promoters (MVPs), and it sometimes pays to thank them for it. Not only does it double down on a great experience, but they also give great testimonials!

Depending on the size of your business, it may not be practical to contact every MVP who gives your business a high score—sometimes you have to prioritise. For example, you may choose to order them by those who have been uncontacted the longest since the survey, or those who are the most valuable to your business (e.g. those in a segment that does a lot of business with you).

Your Net Promoter Score program is intended to gather accurate, useful data. If you are skewing your results, one way or the other, you are producing the opposite. It doesn’t just make it seem like you’re doing better or worse than you are—it could impact your entire customer retention strategy, and not in a good way. If you want to avoid creating unintentional bias, don’t make any of these five common mistakes:

An effective email survey is all about accurate, unbiased communication. Your customers will receive an introduction email, the survey itself, and potentially a follow-up email—at a minimum. What is said in these emails could influence how customers respond to a significant degree.

One example of this is including something like: “Do you think we deserve a high score?”. Asking in this fashion means that you are placing too much significance on the score itself for the customer; simply asking this question so directly could also influence your customer into scoring higher than they otherwise might.

Honest feedback, even if it is negative, is valuable. The above example is extreme, but even subtle changes in word choice or phrasing could impact your survey results. Stay as neutral as possible if you want accuracy.

Compare these two surveys: one is asked just before you release a new product or start a significant marketing campaign, and one is asked just after. Do you think there could be a difference in the opinions of your customers?

This can be an effective way to determine the success of a single business move. But if you only ever ask when you are likely to receive high scores, you are not seeing the full spectrum of your customers’ everyday experience. The exception to this rule is when you’d send a touchpoint survey, for example after onboarding a new customer or gathering feedback from board members. Ideally, you’d launch your survey in what’s referred to as a “steady-state” environment–your standard state of affairs with no big events either side.

You might be cherry picking survey respondents without even knowing it: by selecting customers who are new on the platform, letting your sales or service team hand-select customers, or excluding customers likely to churn.

All of your customers who have the potential to influence the relationship with your company should be included in the contact list. It may be a good idea to have someone who is impartial to the business or process to review the list a final time before deploying the survey.

Deciding what scores are included in your NPS equation can be tricky. It might seem sensible to include them all.

However, you need to consider decision makers compared to end users or multiple respondents from a single customer account. You risk skewing the score based on who’s invited to respond, who responds, how you weight respondents, and so on.

You can do this in several ways: count all of your responses, averaging them all, and the waterfall method. Regardless which approach you use, it’s important to remember that your process and methodology stay consistent when you analyse your survey results.

You can deploy and monitor your surveys by several means, either online, over the phone, or in person. Each of these methods can impact responses.

People tend to be more honest (i.e. have a tendency to be more critical), when the survey doesn’t involve face-to-face contact. To avoid a positive skew, you should avoid face-to-face responses for this reason.

Phone surveys can work really well, but unless they’re conducted by an independent interviewer, they can be quite biased as well.

The best method overall is an online survey, for multiple reasons. They are completed behind the safety and anonymity of a computer screen, and when the respondent has enough time and is not rushed (usually they are very brief and quick). This allows for the most honest and reliable feedback.

Don’t do the biggest mistake that a lot of businesses do: to just calculate their NPS and stop there. NPS is in fact a great way to start a conversation with your customers and to understanding them better so that you can make improvements.

You can improve retention and create loyal customers only if you’re able to connect with them and close the loop to address their opinions in a focused, targeted way. Here are four NPS tricks that most businesses don't make use of enough, and using these will go a long way to transforming your business to be customer focused.

Each respondent does deserve some form of response, regardless of what rating they’ve given you. It’s a quick process and you’ll want to leverage the opportunity to talk to everyone who took the time to give you feedback.

You’ll get the most value from NPS if you’re able to identify and address survey responses with the outcome of starting conversations. This can be as easy as a simple thanks for feedback, solving your customer’s problems, or digging further for more information.

If your sample size is manageable, you can answer each response manually. But if you start getting a large volume of responses making it difficult to handle each communication personally, you’ll want to separate your respondents into segments, each with their own strategy for action.

Related content: The customer retention playbook

You might think you know what your biggest issues are but until you actually go out and ask your customers you won’t 1) know for sure and have actual data behind your assumptions or 2) know how big the issue actually is, in proportion to other potential issues. How to do this best?

Send out two surveys to two different batches of customer samples. The first survey should give you your status quo, but if you then action the negative feedback you receive straight away (i.e. change any frustrating features that your customers feel aren’t working), basically act on your feedback promptly. Then, send out another survey a while after (to another sample group) and subsequently you should be able to see the positive effect your action has had.

You might feel that in your first NPS survey you get a reasonably “good” score. However, what’s more important is in fact the trends you can pick up on. As with any metric, a single, individual number isn’t very useful, but by tracking the long term trend, this enables you to make smart business decisions.

Related content: Why reducing customer churn is crucial to your bottom line

In addition to asking for a numerical rating, to make the most of NPS you should also ask for more information. To keep it simple, as per the NPS methodology, plan your follow-ups accordingly. Ideally you’d want to prepare one automated follow-up question for each customer segment.

To use this strategically, you’d want the question to decipher the feedback that you can use to turn detractors and passives into promoters, and promoters into referrers.

For example:

The reason you’re using NPS is for more than “simply” score. Not only do you have a score at the end of your survey but equally you’ll have a ton of anecdotal data to dig into.

If you tie your actions together with the more emotive elements this is a powerful combo. You’ll get to the essence of the ‘voice of customer’ reaction, by investigating the open anecdotal feedback provided along with the NPS score, to get your most valuable customer insights.

Using the qualitative feedback helps to enhance and could even help explain any issues you may have with products, for example if you simply can’t get to the root of sources of dissatisfaction on the face of things. One of the biggest advantages of NPS is unlocking the customer’s voice.

If you want your NPS surveys to deliver powerful insights and help you grow customer loyalty, you need to consider the following factors and how they can affect your NPS surveys and response quality.

You’re having a busy day at work, and you’re sent a survey of 10 or even 20 questions. It may be from a company that you like and have a good relationship with, but how likely are you to fill it out?

You need plenty of responses to get a firm grip on your NPS. An inaccurate NPS percentage is even worse than not knowing it at all.

The solution? Keep it short. The “would you recommend?” NPS question is all you need in addition to a simple follow-up question such as: “What’s your reason for giving that score?”. Afterwards, you can apply additional measurement to your answers to seek out the reasons for the highs and lows.

If you send all of your customers the same survey at the same time, it only gives you a point-in-time snapshot view. What if you’re planning to add features or functionality to your product next month? It could be three to six months before you see how that affects your score.

Drip feeding NPS over time allows you to capture customer sentiment more accurately. The exception to this rule is when garnering feedback related to a specific transaction or interaction.

The key here is to send out continuous NPS surveys to a portion of your customer base on a regular basis (be it daily, weekly or monthly, depending on your business) to get a rolling view and manage the feedback process more effectively.

Sending out the surveys and gathering data can be a one person job. But subsequently using the insights from the surveys to improve the company’s customer experience should be a company-wide effort.

Involve more employees in the project, and create a few NPS “champions” in each team. Creating a cross-functional team and reporting back on the findings can also be an effective way to go about it.

Regardless of your methods, the goal of NPS is to make your company customer-focused. To do that, everybody needs to be on board.

As good as NPS may be, it can be a mistake to rely only on NPS to gauge your customer satisfaction. It's really only one of many measures. Depending on your company and business model, it may be useful to have focus groups, telephone interviews, support tickets or even face-to-face interviews.

Learning what customers really think of your business doesn't have to be hard or time consuming. Request a free demo—your customers deserve it!